The Greatest Guide To Eb5 Investment Immigration

The Greatest Guide To Eb5 Investment Immigration

Blog Article

Eb5 Investment Immigration for Dummies

Table of Contents4 Simple Techniques For Eb5 Investment ImmigrationOur Eb5 Investment Immigration IdeasEb5 Investment Immigration Things To Know Before You Get ThisThe Eb5 Investment Immigration DiariesSome Ideas on Eb5 Investment Immigration You Need To Know

While we make every effort to provide accurate and updated web content, it must not be taken into consideration lawful suggestions. Migration laws and regulations are subject to change, and specific circumstances can vary widely. For customized advice and legal guidance regarding your details migration situation, we strongly advise talking to a qualified immigration attorney that can supply you with customized help and make certain conformity with current laws and policies.

Citizenship, through financial investment. Currently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Locations and Country Areas) and $1,050,000 in other places (non-TEA areas). Congress has actually approved these amounts for the following five years starting March 15, 2022.

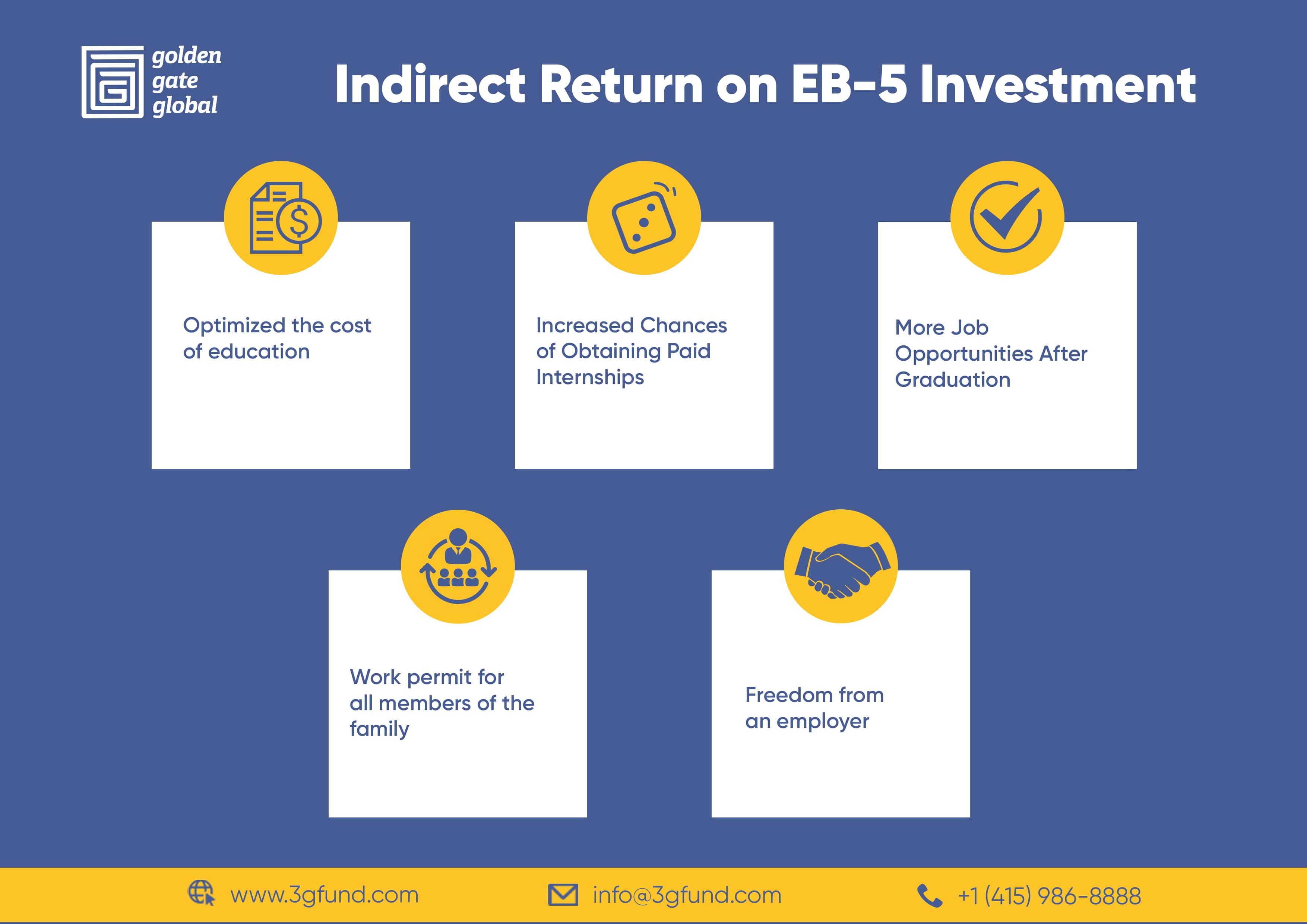

To receive the EB-5 Visa, Investors should produce 10 full time united state jobs within two years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Need makes sure that financial investments contribute directly to the united state work market. This uses whether the tasks are developed directly by the commercial business or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

Eb5 Investment Immigration Fundamentals Explained

These tasks are determined via models that utilize inputs such as development expenses (e.g., construction and equipment expenditures) or yearly incomes generated by ongoing operations. On the other hand, under the standalone, or straight, EB-5 Program, only straight, permanent W-2 employee positions within the business may be counted. A vital danger of counting entirely on straight workers is that team decreases due to market conditions can lead to not enough full-time placements, potentially bring about USCIS rejection of the investor's petition if the work production demand is not met.

The economic design after that predicts the number of straight tasks the brand-new service is most likely to create based on its awaited earnings. Indirect tasks computed with financial models describes work generated in industries that explanation provide the goods or services to business straight associated with the job. These jobs are produced as a result of the raised demand for items, materials, or solutions that sustain business's operations.

More About Eb5 Investment Immigration

An employment-based fifth preference group (EB-5) financial investment visa gives a technique of coming to be a long-term united state citizen for foreign nationals wishing to invest capital in the United States. In order to use for this permit, an international financier must invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and produce or preserve at least 10 full time tasks for United States employees (leaving out the financier and their immediate family).

This action has actually been an incredible success. Today, 95% of all EB-5 resources is raised and spent by Regional Centers. Given that the 2008 economic dilemma, access to resources has been tightened and community budgets remain to face considerable news shortages. In many regions, EB-5 financial investments have filled the funding void, supplying a brand-new, essential source of funding for local economic advancement projects that rejuvenate areas, produce and support tasks, facilities, and solutions.

3 Simple Techniques For Eb5 Investment Immigration

employees. Additionally, the Congressional Spending Plan Workplace (CBO) racked up the program as income neutral, with management expenses spent for by candidate costs. EB5 Investment Immigration. More than 25 countries, consisting of Australia and the UK, use similar programs to attract foreign financial investments. The American program is more stringent than many others, requiring considerable threat for capitalists in terms of both their financial investment and immigration standing.

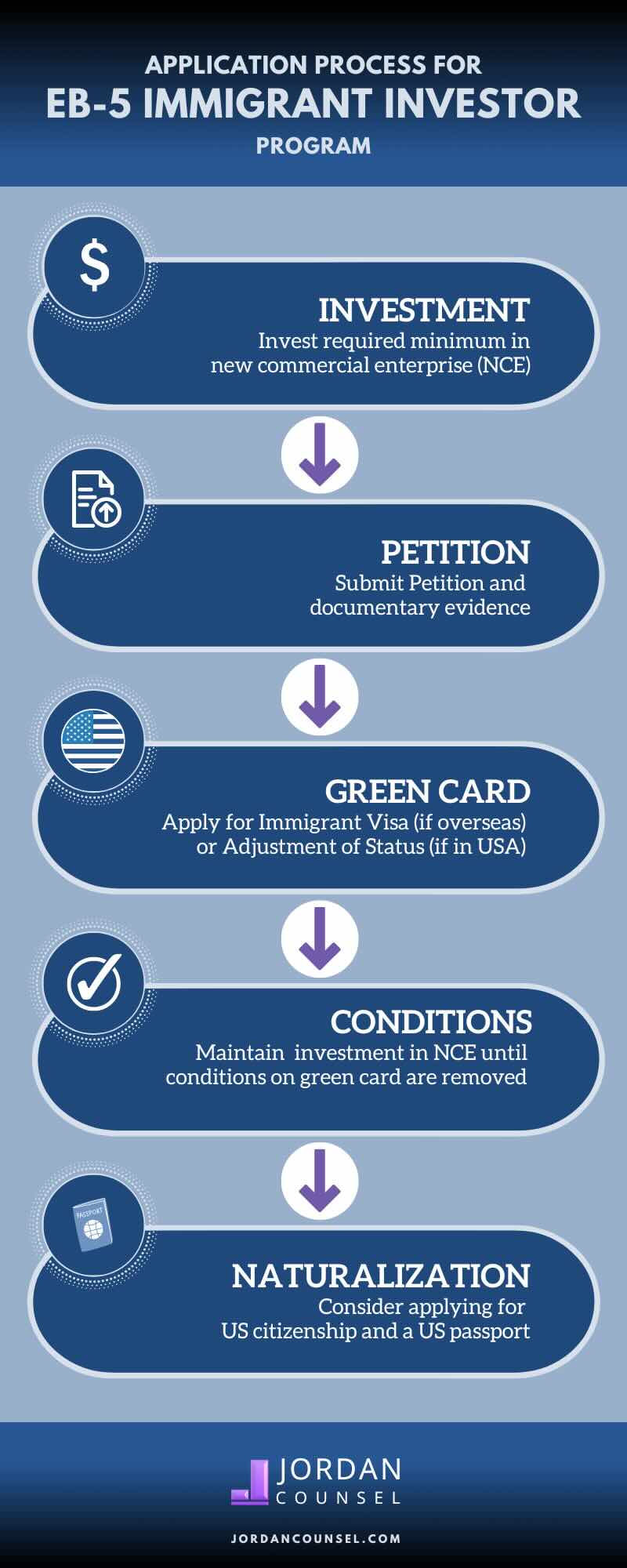

Families and individuals that look for to move to the United States on a long-term basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) set out various needs to acquire permanent residency via the EB-5 visa program.: The first step is to locate a certifying financial investment opportunity.

Once the opportunity has been determined, the financier has to make the financial investment and send an I-526 petition to the united state Citizenship and Migration Services (USCIS). This application has to consist of proof of the financial investment, such as bank statements, acquisition arrangements, and company strategies. The USCIS will certainly evaluate the I-526 request and either accept it or request added evidence.

Rumored Buzz on Eb5 Investment Immigration

The financier needs to obtain conditional residency by submitting an I-485 application. This request should be sent within 6 months of the I-526 approval and have to consist of proof that the investment was made and that it has actually produced a minimum of 10 full time jobs for united state workers. The USCIS will examine the I-485 request and either approve it or request added evidence.

Report this page